psm-khabarovsk.ru

Gainers & Losers

Solo K Retirement Plan

A solo (k) is a tax-advantaged retirement account for self-employed business owners. A solo (k) is the same as a large company (k) but limited to just. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. What are the advantages of a Solo (k)? · Salary Deferral Contribution · Business Contribution · Maximum Contribution · No Special Custodian Needed · Personal. The only retirement plan that cannot roll into a Solo k is a Roth IRA as per IRS rules. Who helps me do the rollover? The Nabers Group team is here to help. Owner-only or self-employed (k) plans are designed for business owners - with no employees other than their spouses - to save for retirement. An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your. Who is eligible for an individual or solo (k) plan? Generally, only businesses that consist of an owner and a spouse, if that individual also works for the. Ascensus' Individual(k) plans are easy-to-implement, cost-effective, and designed to help self-employed individuals save for retirement. A solo (k) is a tax-advantaged retirement account for self-employed business owners. A solo (k) is the same as a large company (k) but limited to just. Simple, low-cost, full-scale – our flexible Solo (k) plans allow self-employed individuals to maximize their retirement savings and still enjoy the same. A Self-Employed (k), also called a solo (k), is a version of the traditional (K) that provides high savings potential for solo business owners. What are the advantages of a Solo (k)? · Salary Deferral Contribution · Business Contribution · Maximum Contribution · No Special Custodian Needed · Personal. The only retirement plan that cannot roll into a Solo k is a Roth IRA as per IRS rules. Who helps me do the rollover? The Nabers Group team is here to help. Owner-only or self-employed (k) plans are designed for business owners - with no employees other than their spouses - to save for retirement. An Individual(k)—also known as Individual (k)—maximizes retirement savings if you're self-employed or a business owner with no employees other than your. Who is eligible for an individual or solo (k) plan? Generally, only businesses that consist of an owner and a spouse, if that individual also works for the. Ascensus' Individual(k) plans are easy-to-implement, cost-effective, and designed to help self-employed individuals save for retirement.

A Solo (k) plan is an employer sponsored retirement savings plan that is designed specifically for owner-only businesses. Good question and the answer is yes. In order for either spouse to contribute to the solo k plan, whether employee or employer contributions, the spouse that. Owner-only or self-employed (k) plans are designed for business owners - with no employees other than their spouses - to save for retirement. A type of (k) plan designed specifically for owner-only businesses. With higher maximum contribution levels, loans, and the ability to consolidate your. A Solo (k), also known as an Individual (k) or a self-employed (k), is a retirement savings plan designed for self-employed individuals. Explore Solo k plans for self-employed individuals. TRA (k) offers customized self-employed k or individual k solutions to optimize your. Contributions to an Individual (k) Plan can help reduce your current taxable income while saving for retirement. · Choice of either pre-tax and/or after-tax . A self-employed (k), also called individual (k) or solo (k), is a retirement savings plan for sole proprietors, independent contractors, and other. The Solo (k) is the premier retirement savings plan account available for individuals with self-employment income. An Individual (k) is a flexible plan offering tax benefits and high contribution limits to self-employed people and owner-only businesses. Self-employed individuals and owner-only businesses and partnerships can save more for retirement through a (k) plan designed especially for them. A one-participant (k) plan is sometimes referred to as a “solo(k),” “individual (k)” or “uni(k).” It is generally the same as other (k) plans. A Solo (k) plan is a defined contribution plan designed for the sole business owner with no employees other than a spouse. Legal entities, such as C. The individual (k) - also known as the solo (k), the solo k, or uni-k - works much the same as traditional (k) plans offered by large companies. The only retirement plan that cannot roll into a Solo k is a Roth IRA as per IRS rules. Who helps me do the rollover? The Nabers Group team is here to help. The solo (k) is designed for use by sole proprietors, freelancers, and independent contractors. As such, it eliminates much of the paperwork and bureaucracy. The self-directed Solo (k) (also known as Individual (k), Self-Employed (k), and Solo(k)) is often the most attractive plan to investors, if they. The individual (k) - also known as the solo (k), the solo k, or uni-k - works much the same as traditional (k) plans offered by large companies. Contributions to an Individual (k) Plan can help reduce your current taxable income while saving for retirement. · Choice of either pre-tax and/or after-tax . Individual (k) Plan with Traditional and Roth (k) contributions · For self-employed workers and their spouses to maximize retirement savings · Generous.

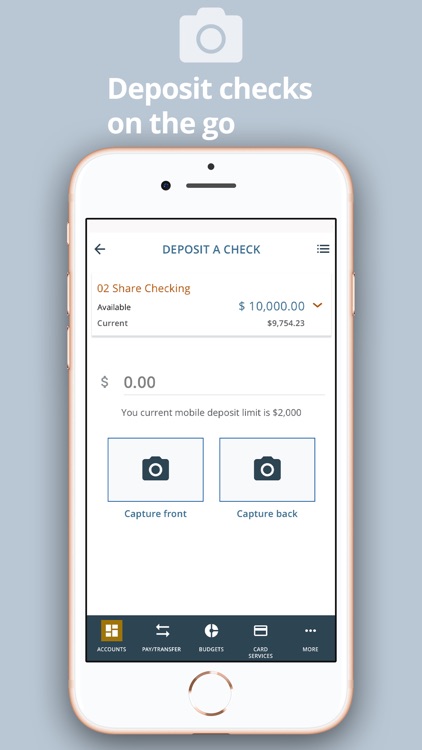

Schoolsfirst Federal Credit Union Mobile Banking App

A new Mobile Banking app for Android is ready to download! Mobile Banking has been updated with a new design and more functionality to better serve you. See what employees say it's like to work at SchoolsFirst Federal Credit Union. Salaries, reviews, and more - all posted by employees working at SchoolsFirst. Enjoy millions of the latest Android apps, games, music, movies, TV, books, magazines & more. Anytime, anywhere, across your devices. Not with all the bells and whistles as the big banks. The app allows me to quickly look at transactions without having to log on. Mobile. Software QA Analyst at SchoolsFirst Federal Credit Union · I started my banking mobile app, or our banking system. My reputation caught notice of the. SchoolsFirst FCU standard materials such as brochures, permanent branch merchandising signage, powerpoint slides, and mobile banking. If you are not sure. Service & Support; Mobile & Online Banking · Zelle · Direct Deposit · Activate Debit Card · Wire Transfers · Cómo le Servimos. Amy S. Customer Service. Our sincere apologies for your experience with our Mobile Banking read more. Download the app from the Apple App Store or the Google Play Marketplace. · Login from the device using your current eBanking credentials. A new Mobile Banking app for Android is ready to download! Mobile Banking has been updated with a new design and more functionality to better serve you. See what employees say it's like to work at SchoolsFirst Federal Credit Union. Salaries, reviews, and more - all posted by employees working at SchoolsFirst. Enjoy millions of the latest Android apps, games, music, movies, TV, books, magazines & more. Anytime, anywhere, across your devices. Not with all the bells and whistles as the big banks. The app allows me to quickly look at transactions without having to log on. Mobile. Software QA Analyst at SchoolsFirst Federal Credit Union · I started my banking mobile app, or our banking system. My reputation caught notice of the. SchoolsFirst FCU standard materials such as brochures, permanent branch merchandising signage, powerpoint slides, and mobile banking. If you are not sure. Service & Support; Mobile & Online Banking · Zelle · Direct Deposit · Activate Debit Card · Wire Transfers · Cómo le Servimos. Amy S. Customer Service. Our sincere apologies for your experience with our Mobile Banking read more. Download the app from the Apple App Store or the Google Play Marketplace. · Login from the device using your current eBanking credentials.

With SchoolsFirst FCU Mobile Banking you have the freedom, convenience and security to manage your accounts from your iPhone or iPad anytime, anywhere. Banks are for profit, while credit unions are Member-owned financial Mobile & Online Banking · Fraud & Security · Cómo le Servimos · Member Advocate. SchoolsFirst Federal Credit Union. Alton Square. Offering full service banking and loans. Download the Retail Therapy App. Hundreds of deals on shopping. SchoolsFirst FCU Members have access to an easy and secure way to make one-time or recurring payments through Online and Mobile Banking. Why Use Online Banking? · Paying bills online · Transferring funds · Viewing & printing eStatements · Opening additional share accounts · Viewing cleared checks. Alma Bank · Aloha Pacific FCU · Alpine Bank · Alta Vista Credit Union · Altamaha Bank and Trust · Altana Federal Credit Union · Altoona First Savings Bank · Altura. SchoolsFirst FCU down? Check whether psm-khabarovsk.ru server is down right now or having outage problems for everyone or just for you. A new Mobile Banking app for Android is ready to download! Mobile Banking has been updated with a new design and more functionality to better serve you. Brand new member to schools first! Mistee was so helpful and kind! I'm excited to be a part of this bank. Deposited a large amount of cash and the ladies were. SchoolsFirst Credit Union is an amazing bank; let me say they treat you like family. I'm so impressed with their service and how they handle loans. Zelle is available in Mobile Banking under "Transfer." Enroll with Zelle through the app in just a few simple steps. Send or get your first payment faster —. ), Online & Mobile Banking will still be available 24/7 for your convenience. Emergency Card Support () is available days, 5 am–10pm. SchoolsFirst FCU accounts via Online and Mobile Banking is provided for your information. FCU," and "Credit Union" refer to SchoolsFirst Federal Credit Union. Tap here to call and confirm hours. Los Angeles, CA · Financial Services · Banks & Credit Unions. SchoolsFirst Federal Credit Union mobile banking app. The problem is, the zelle transfer would take at least 3 days. A few months in, I always had to transfer money from external account, pay my bank for the. Uses bank-grade security measures to help protect your money. No fees for sending or receiving money when you use Zelle through Mobile Banking. Whether you need. SchoolsFirst FCU Mobile Banking app is a free, efficient, and secure platform for iPhone users to manage their accounts. Chase Mobile® app - Manage your accounts, deposit checks, transfer money and more -- all from your device. JPMorgan Chase Bank, N.A. Member FDIC; Open your. Savings; Checking; Consumer loans; Auto loans; Mortgages; Credit cards; Investments; Retirement; Insurances; Online banking; Mobile banking · Total assets. Remember, you can always use the Mobile App to Lock/Unlock your card to prevent unauthorized use. The Supervisory Committee consists of members selected by.

When Will More Houses Come On The Market

See more real estate market trends for Toledo If you're buying a home in Toledo, you could pay more than the asking price. Use CENTURY 21 to find real estate property listings, houses for sale, real estate agents, and a mortgage calculator. We can assist you with buying or. When the market reaches your price point, you sell the property just as you would a stock that has appreciated. This may not be a practical approach for your. Landlords should refer to the landlord guide for housing help in MA. Skip Learn more about other services you may be eligible for. Take this short. What is happening to house prices? The housing market lost momentum in , and prices began to fall as high mortgage rates and a lingering cost of living. New Listings: Indicates how many new listings have come on the market in a given month. Newly Pending Listings: The count of listings that changed from for. For more information, use the links below to see each indicator's methodology page. You will also find a list of resources on our Research and Data FAQ page. New Houses Sold and For Sale by Stage of Construction and Median Number of Months on Sales Market. (Thousands of Units. Detail may not add to total because. The housing market typically suffers from a bubble burst when the demand for houses diminishes while the supply continues to increase. Higher interest rates. See more real estate market trends for Toledo If you're buying a home in Toledo, you could pay more than the asking price. Use CENTURY 21 to find real estate property listings, houses for sale, real estate agents, and a mortgage calculator. We can assist you with buying or. When the market reaches your price point, you sell the property just as you would a stock that has appreciated. This may not be a practical approach for your. Landlords should refer to the landlord guide for housing help in MA. Skip Learn more about other services you may be eligible for. Take this short. What is happening to house prices? The housing market lost momentum in , and prices began to fall as high mortgage rates and a lingering cost of living. New Listings: Indicates how many new listings have come on the market in a given month. Newly Pending Listings: The count of listings that changed from for. For more information, use the links below to see each indicator's methodology page. You will also find a list of resources on our Research and Data FAQ page. New Houses Sold and For Sale by Stage of Construction and Median Number of Months on Sales Market. (Thousands of Units. Detail may not add to total because. The housing market typically suffers from a bubble burst when the demand for houses diminishes while the supply continues to increase. Higher interest rates.

Overview of the Real Estate Market. 4,, existing homes were sold in , according to data from the National Association of REALTORS®. Sales of new. Builder confidence in the market for new single-family homes fell to 39 in August, down two points from a downwardly revised reading of 41 in July. This is the. See more real estate market trends for Toledo If you're buying a home in Toledo, you could pay more than the asking price. The highest number of homes sold typically occurs around May. This seasonal variation is often altered for townhouse sales by a large new development beginning. How lower mortgage rates will impact the housing market. Fri, Aug 23rd We are in a buyer's market for new housing construction, says Ivy Zelman. If you would like to hear from Housing Finance Corporation Content. Live Local Program Tax Credit · Multifamily Middle Market Certification. The decline comes as the median sales price climbed to a record high of $, Meanwhile, total housing inventory was million units, up % from April. It has come to our attention that bad actors are promoting fake housing voucher programs using the Michigan State Housing Development Authority (MSHDA). Does It Make Sense to Buy a House in Tampa? When you see headlines about Tampa having one of the most overpriced housing markets in the country, it may lead you. As more buyers enter the market, the demand for housing increases in turn. And if there remains a limited supply of housing inventory, prices in a low. The median days on the market was 59 days, up 18 year over year. Read More. When the market reaches your price point, you sell the property just as you would a stock that has appreciated. This may not be a practical approach for your. See more real estate market trends for Columbus will receive a lender paid credit that is % of their loan amount. For example, a $, home. Though certain seasons tend to be busier, fluctuations in the housing market are more likely influenced by supply and demand than the season. If you come up. Publicly traded homebuilders tighten grip on U.S. housing market—just look at this map · Aug 20, ; The Fed's dual mandate is coming into play—here's what it. Eligible families will receive a voucher to begin searching for housing. Generally, families will pay no more than 40 percent of their adjusted monthly. For single-family homes, it's the best it's been since October (1, listings) with 1, houses listed in May compared to in April. A "healthy". The new methodology updates and improves the calculation of time on market and improves handling of duplicate listings. Most areas across the country will see. With the current housing market, we've gained a lot of equity. Honestly, I'd love to move, but the ridiculous prices would mean going lateral in.

Open A Business Bank Account Td Bank

Start by visiting the TD Bank website and selecting the 'Business Banking' option from the main menu. Selecting the Right Account Type. TD Bank offers various. What is Business Advantage Banking? How do I apply for a Business Advantage Checking account? We offer 3 convenient ways to open a business checking account. To ensure your account is opened quickly, all owners and signing officers will need to provide 2 pieces of approved personal identification. Depending on your. Small Business Bank Accounts ; TD Everyday Business Plan A. Limited Time Offer: Get up to $ · A budget-friendly plan for everyday business banking. $ The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. How to apply for a business account at TD Bank · Proof of identity and proof of address. · Your business's legal name, address, and phone number, as well as the. How to apply for a business account at TD Bank · Proof of identity and proof of address. · Your business's legal name, address, and phone number, as well as the. My recommendation is to open NOT the minimum account with TD (there is always a $ fee per month), but open the next account up. I think it. Minimum deposit needed to open account. $ Monthly maintenance fee This means your account is setup to allow TD Bank to authorize and pay. ATM or. Start by visiting the TD Bank website and selecting the 'Business Banking' option from the main menu. Selecting the Right Account Type. TD Bank offers various. What is Business Advantage Banking? How do I apply for a Business Advantage Checking account? We offer 3 convenient ways to open a business checking account. To ensure your account is opened quickly, all owners and signing officers will need to provide 2 pieces of approved personal identification. Depending on your. Small Business Bank Accounts ; TD Everyday Business Plan A. Limited Time Offer: Get up to $ · A budget-friendly plan for everyday business banking. $ The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. How to apply for a business account at TD Bank · Proof of identity and proof of address. · Your business's legal name, address, and phone number, as well as the. How to apply for a business account at TD Bank · Proof of identity and proof of address. · Your business's legal name, address, and phone number, as well as the. My recommendation is to open NOT the minimum account with TD (there is always a $ fee per month), but open the next account up. I think it. Minimum deposit needed to open account. $ Monthly maintenance fee This means your account is setup to allow TD Bank to authorize and pay. ATM or.

You can open your account with as little as $25, but you'll need to have a minimum daily balance of $ if you want to get the $5 monthly maintenance fee. Expand Documents needed to open a Business Chequing Account · Sole Proprietorship – Certificate of Registration of Business Name · Partnership – Certificate of. TD Bank has a few big cons. First, it doesn't have any free business checking account. All its accounts come with some monthly fee (though you can waive the fee. Small Business's profile picture. Small Business. Community's profile picture TD Bank checking or savings account. Learn more at the link in our bio. To facilitate your account opening request, we require specific information and/or documentation in order to comply with federal anti-money laundering. Thank you for choosing TD Canada Trust for your business banking needs. We understand that as a business owner, your time is valuable. We have accounts with TD Bank. Here's a map And then ask what documents are required to open an LLC business bank account before you go in in person. TD Canada Trust's business banking accounts breakdown: Account. Monthly Fee Steps to Open a Small Business Bank Account. Opening a Canadian small. 44 votes, comments. Im just starting my business but im really debating a business bank i can trust. Ive heard a lot of stuff around ofc. TD Bank went back to the drawing board with their small business checking — and reintroduced an even more versatile account designed to address real customer. From your My Accounts page that appears when you log in to EasyWeb, select Open a new banking account to start the process. If you prefer to use the TD app, you. Step 3 Have $2, in qualifying direct deposits post to the account within 60 days. Step 1 Open a TD Complete Checking account. Step 2 Set up. TD Bank accounts to a name that is more meaningful to them. For example, if your company has an account that is used specifically to pay Business Expenses. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking, Mobile Banking. Account essentials for your start-up · Small Business Checking Accounts · Online and Mobile Banking · TD Business Solutions Credit Card. What you need to open a bank account A valid, government-issued photo ID, such as a driver's license or a passport. Other basic information, such as your. What you need to open a bank account A valid, government-issued photo ID, such as a driver's license or a passport. Other basic information, such as your. Have your friend open a personal checking account with the referral form at a nearby TD Bank store. Within 60 days of account opening, your friend must either. TD Online Accounting is powered by Autobooks, a trusted technology partner of TD Bank. Get paid faster by making it easier for your customers to pay. With a TD Business Savings account, you get a low minimum opening deposit of $ There's also a low monthly fee of $5, which can be waived by maintaining a.

What Freelance Means

:max_bytes(150000):strip_icc()/freelancer.aspfinal-735c7be9a7d642eabcafa5a0117e4823.jpg)

Simply put, freelancing is a form of self-employment. As a freelancer, you have the freedom to live anywhere with reliable internet connection. A freelancer is a person who pursues an occupation without a long-term commitment to any particular employer. Freelance or Freelancer may also refer to. A freelancer is a person who is self-employed, often working for multiple clients at one time and earning income per project. A freelancer is a person who is not permanently employed by any one company but works independently on behalf of different companies. Freelance work is a type of self-employment that is carried out on a flexible basis, and provided to a variety of different businesses. Freelancers could work. Freelance meaning. Freelance jobs are usually part-time jobs with schedule flexibility. A freelancer is a self-employed individual that possesses a specific set. Freelance is a career option in which individuals work on a project basis. That is, they work on individual projects/tasks that a client offers. To freelance is to work independently, instead of for a long-term employer. If you do freelance work, you're free to say yes or no to any project. Freelancer What is Freelancer? · Freelancer Definition An independent labourer earning wages per job is known as a freelancer. · Examples of Freelancers · Taxes. Simply put, freelancing is a form of self-employment. As a freelancer, you have the freedom to live anywhere with reliable internet connection. A freelancer is a person who pursues an occupation without a long-term commitment to any particular employer. Freelance or Freelancer may also refer to. A freelancer is a person who is self-employed, often working for multiple clients at one time and earning income per project. A freelancer is a person who is not permanently employed by any one company but works independently on behalf of different companies. Freelance work is a type of self-employment that is carried out on a flexible basis, and provided to a variety of different businesses. Freelancers could work. Freelance meaning. Freelance jobs are usually part-time jobs with schedule flexibility. A freelancer is a self-employed individual that possesses a specific set. Freelance is a career option in which individuals work on a project basis. That is, they work on individual projects/tasks that a client offers. To freelance is to work independently, instead of for a long-term employer. If you do freelance work, you're free to say yes or no to any project. Freelancer What is Freelancer? · Freelancer Definition An independent labourer earning wages per job is known as a freelancer. · Examples of Freelancers · Taxes.

FREELANCE meaning: 1: earning money by being hired to work on different jobs for short periods of time rather than by having a permanent job with one. What this means is that most companies hire by the project rather than into permanent roles. This is particularly common in film, TV and animation where you are. Meta Description: A freelancer is a person who works independently and is self-employed, without any long-time ties to a particular employment. Going freelance means starting a business, so you'll have to get to grips with your finances, general admin and paying taxes - areas you may not know much about. A freelance is an independent contractor who provides services to clients on a project basis. Freelancers are self-employed and not considered. Hiring a freelance writer means getting the work done correctly, accurately, and professionally without putting pressure on an unqualified employee. For. Flexible working hours. Being a freelancer means you don't have to be present in the office from 8 a.m. to 4 p.m. Instead, they can work anytime according. Someone who does freelance work or who is, for example, a freelance journalist or photographer is not employed by one organization, but is paid for each piece. Freelancing Meaning: Freelance job means working on a contract or project basis. The person hired by the company or client is known as the person to help them. Being a freelancer means having a bandwidth of autonomy over your work conditions. It's an alternative to working full-time, part-time, or some other type of. Freelance freelancer, or freelance worker, are terms commonly used for a person who is self-employed and not necessarily committed to a particular employer. Freelancing is doing specific work for clients without committing to full-time employment. Freelancers often take on multiple projects with different clients. You may be wondering, “so what is freelancing?” Freelancing means to work as an independent company rather than be employed by someone else. Freelancing means to work for yourself as your own boss, getting hired by clients to perform services or create products. Freelancing is a form of work where the worker and the buyer have no fixed obligation to each other beyond the current gig, project or assignment. Being a freelancer just means being a gun for hire. It's a legal distinction that implies you're paid as an independent contractor, have very few rights or. Freelance definition: To act independently without orders from another. What Does it Mean to Be a Freelancer? Freelancers are self-employed. As a freelancer, you provide work to clients and invoice them for it. The type of clients. Working independently is often classified as freelance or self-employed. Learn what the difference is and protect it with business insurance. Freelance economy refers to a labor market consisting of a growing number of short-term contracts. Companies hire self-employed workers to undertake specific.

Top 10 Business Credit Cards

Business Credit Cards ; Ink Business Premier Credit Card · Earn $1, bonus cash back · Pay in Full Card with Unlimited Earn Potential ; Ink Business Unlimited. 10% Business Relationship Bonus. If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary, you'll earn a one. The best business credit cards include Ink Business Unlimited, Venture X Business and U.S. Bank Business Triple Cash Rewards, among other options. American Express Blue Business Cash Card · American Express Blue Business Plus Credit Card · Bank of America Business Advantage Unlimited Cash Rewards Mastercard. Best business credit cards of September · + Show Summary · Ink Business Unlimited® Credit Card · Ink Business Cash® Credit Card · Capital One Spark. Best Travel Business Credit Card: Chase Ink Business Preferred® Credit Card · Best credit card for starting a business: The American Express Blue Business Cash™. Find the perfect business credit card for your small business needs. Compare rewards, APR, and more from trusted partners on Nav's platform. You must pay your full balance every month. Great for high-spending businesses that pay their balance in full and want best-in-class travel rewards. We're going to cover 10 of the best business credit cards available for LLCs, and what your LLC needs to consider to choose the right credit card for your. Business Credit Cards ; Ink Business Premier Credit Card · Earn $1, bonus cash back · Pay in Full Card with Unlimited Earn Potential ; Ink Business Unlimited. 10% Business Relationship Bonus. If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary, you'll earn a one. The best business credit cards include Ink Business Unlimited, Venture X Business and U.S. Bank Business Triple Cash Rewards, among other options. American Express Blue Business Cash Card · American Express Blue Business Plus Credit Card · Bank of America Business Advantage Unlimited Cash Rewards Mastercard. Best business credit cards of September · + Show Summary · Ink Business Unlimited® Credit Card · Ink Business Cash® Credit Card · Capital One Spark. Best Travel Business Credit Card: Chase Ink Business Preferred® Credit Card · Best credit card for starting a business: The American Express Blue Business Cash™. Find the perfect business credit card for your small business needs. Compare rewards, APR, and more from trusted partners on Nav's platform. You must pay your full balance every month. Great for high-spending businesses that pay their balance in full and want best-in-class travel rewards. We're going to cover 10 of the best business credit cards available for LLCs, and what your LLC needs to consider to choose the right credit card for your.

Best Business Credit Cards of August ; Chase Ink Business Premier℠ Credit Card. Rewards bonus. $1, APR. Flex for Business variable | APR: %%. The American Express Blue Business Cash™ Card *: Best for smaller businesses and independent ventures. All information about The Blue Business® Plus Credit Card. Choose a category. · Filter by card feature · U.S. Bank Business Altitude™ Power World Elite Mastercard® · U.S. Bank BUSINESS ALTITUDE™ CONNECT WORLD ELITE. Our overall best business store credit card is great for small business owners who frequently shop on Amazon but do not have an Amazon Prime membership. This. Explore insightful business credit card options with 10xTravel. Our expert advice and easy-to-follow tips are designed to assist your financial journey. Business credit cards can offer a range of benefits. These include rewards or cash back, loyalty points, travel protections and expense management. Your Sound credit card will arrive to your mailbox in 7 to 10 business days. Back to Top Button Back to top. Disclosures. ¹Certain terms, conditions, and. Ink Business Preferred® Credit Card: Best for bonus earning · Capital One Venture X Business: Best for businesses with high-spending · The Business Platinum Card®. The Chase Ink Business Cash credit card makes the number two spot in my favorites list for small business owners. I've had this card for over 10 years and love. The Business Gold Card, Now Available in White Gold · Let Your Business Power Your Stay with Enhanced Hilton Honors Benefits · Find the Best Card for Your. 10 Best Business Credit Cards · Chase Ink Business Preferred · Capital One Spark Cash for Business · Chase Ink Business Cash Credit Card · The Business Platinum. The right business credit card can help you book travel and earn rewards for your spending. Compare the top business cards today. Business Credit Cards ; 0% for 12 months. N/A. % - % Variable ; Annual Fee ; $0 ; Apply for Ink Business Cash Credit Card. Business Advantage Unlimited Cash Rewards Mastercard Secured credit card · Help strengthen your business credit while earning unlimited cash back · Business. Ink Business Preferred® Credit Card. Earn , bonus points after you spend $8, on purchases in the first 3 months from account opening. Compare Best Business Cards ; Card Overview · $ Annual Fee ; Card Overview · $ Annual Fee. Small Business Credit Cards · Mastercard® Business Credit Card · Mastercard® Business Rewards Credit Card · BMO Business Platinum Credit Card · BMO Business. Capital One Spark Cash; Chase; Citi; FNBO; Navy Federal CU; PNC; US Bank; Wells Fargo. The following banks do report business cards on personal credit reports . Ink Business Preferred® Credit Card. Earn , bonus points after you spend $8, on purchases in the first 3 months from account opening. Coming full-circle, former credit card company turned expense management software, Expensify, has also created a corporate credit card offering to compete in.

2 3 4 5 6